Spread Duration Of Credit . spread duration is the sensitivity of a security’s price to changes in its credit spread. Dts), is a market standard for measuring the credit volatility of a corporate bond. dxs (duration times spread duration a.k.a. It is calculated by simply. It quantifies the sensitivity of a bond’s price. In other words, the spread is the difference in returns due to different credit qualities. duration times spread (dts) is the market standard method for measuring the credit volatility of a corporate bond. credit spread is the difference between the yield (return) of two different debt instruments with the same maturity but different credit ratings. It is calculated by simply. spread duration is a measure of the percentage change in a bond’s price for a given change in its credit spread. spread duration is ideal for analyzing credit risk, modified duration for assessing interest rate risk, effective.

from www.financestrategists.com

It is calculated by simply. In other words, the spread is the difference in returns due to different credit qualities. spread duration is a measure of the percentage change in a bond’s price for a given change in its credit spread. dxs (duration times spread duration a.k.a. spread duration is the sensitivity of a security’s price to changes in its credit spread. Dts), is a market standard for measuring the credit volatility of a corporate bond. credit spread is the difference between the yield (return) of two different debt instruments with the same maturity but different credit ratings. duration times spread (dts) is the market standard method for measuring the credit volatility of a corporate bond. It is calculated by simply. spread duration is ideal for analyzing credit risk, modified duration for assessing interest rate risk, effective.

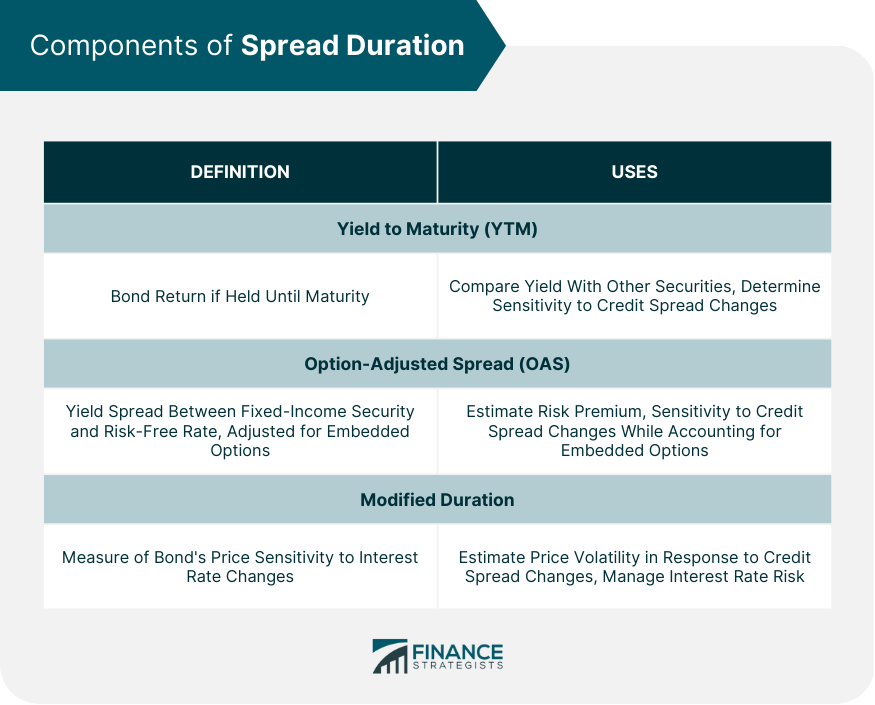

Spread Duration Definition, Components, & Applications

Spread Duration Of Credit spread duration is a measure of the percentage change in a bond’s price for a given change in its credit spread. credit spread is the difference between the yield (return) of two different debt instruments with the same maturity but different credit ratings. In other words, the spread is the difference in returns due to different credit qualities. Dts), is a market standard for measuring the credit volatility of a corporate bond. spread duration is the sensitivity of a security’s price to changes in its credit spread. It is calculated by simply. spread duration is ideal for analyzing credit risk, modified duration for assessing interest rate risk, effective. It quantifies the sensitivity of a bond’s price. spread duration is a measure of the percentage change in a bond’s price for a given change in its credit spread. dxs (duration times spread duration a.k.a. duration times spread (dts) is the market standard method for measuring the credit volatility of a corporate bond. It is calculated by simply.

From www.projectfinance.com

Credit Spread Options Strategies (Visuals and Examples) projectfinance Spread Duration Of Credit In other words, the spread is the difference in returns due to different credit qualities. It quantifies the sensitivity of a bond’s price. It is calculated by simply. Dts), is a market standard for measuring the credit volatility of a corporate bond. spread duration is ideal for analyzing credit risk, modified duration for assessing interest rate risk, effective. It. Spread Duration Of Credit.

From www.youtube.com

Understanding credit spread duration and its impact on bond prices Spread Duration Of Credit In other words, the spread is the difference in returns due to different credit qualities. dxs (duration times spread duration a.k.a. spread duration is a measure of the percentage change in a bond’s price for a given change in its credit spread. It quantifies the sensitivity of a bond’s price. duration times spread (dts) is the market. Spread Duration Of Credit.

From www.slideserve.com

PPT Duration times spread PowerPoint Presentation ID3950949 Spread Duration Of Credit spread duration is a measure of the percentage change in a bond’s price for a given change in its credit spread. Dts), is a market standard for measuring the credit volatility of a corporate bond. dxs (duration times spread duration a.k.a. spread duration is the sensitivity of a security’s price to changes in its credit spread. . Spread Duration Of Credit.

From exoovksgk.blob.core.windows.net

Duration Time Spread Investopedia at John Wiest blog Spread Duration Of Credit In other words, the spread is the difference in returns due to different credit qualities. It is calculated by simply. dxs (duration times spread duration a.k.a. spread duration is ideal for analyzing credit risk, modified duration for assessing interest rate risk, effective. spread duration is the sensitivity of a security’s price to changes in its credit spread.. Spread Duration Of Credit.

From www.simplertrading.com

Options Spreads 101 A Beginner’s Guide Simpler Trading Spread Duration Of Credit It is calculated by simply. duration times spread (dts) is the market standard method for measuring the credit volatility of a corporate bond. dxs (duration times spread duration a.k.a. Dts), is a market standard for measuring the credit volatility of a corporate bond. spread duration is ideal for analyzing credit risk, modified duration for assessing interest rate. Spread Duration Of Credit.

From www.financestrategists.com

Spread Duration Definition, Components, & Applications Spread Duration Of Credit In other words, the spread is the difference in returns due to different credit qualities. spread duration is ideal for analyzing credit risk, modified duration for assessing interest rate risk, effective. It is calculated by simply. It is calculated by simply. spread duration is a measure of the percentage change in a bond’s price for a given change. Spread Duration Of Credit.

From www.slideserve.com

PPT Chapter 22 Credit Derivatives PowerPoint Presentation, free Spread Duration Of Credit credit spread is the difference between the yield (return) of two different debt instruments with the same maturity but different credit ratings. duration times spread (dts) is the market standard method for measuring the credit volatility of a corporate bond. Dts), is a market standard for measuring the credit volatility of a corporate bond. In other words, the. Spread Duration Of Credit.

From analystprep.com

Term Structure of Credit Spreads CFA, FRM, and Actuarial Exams Study Spread Duration Of Credit dxs (duration times spread duration a.k.a. spread duration is a measure of the percentage change in a bond’s price for a given change in its credit spread. It is calculated by simply. credit spread is the difference between the yield (return) of two different debt instruments with the same maturity but different credit ratings. It is calculated. Spread Duration Of Credit.

From fabalabse.com

What is an example of a credit spread? Leia aqui What are typical Spread Duration Of Credit It is calculated by simply. spread duration is ideal for analyzing credit risk, modified duration for assessing interest rate risk, effective. It is calculated by simply. dxs (duration times spread duration a.k.a. credit spread is the difference between the yield (return) of two different debt instruments with the same maturity but different credit ratings. In other words,. Spread Duration Of Credit.

From analystprep.com

Credit Spreads and Creditsensitive Instruments CFA, FRM Spread Duration Of Credit It is calculated by simply. spread duration is ideal for analyzing credit risk, modified duration for assessing interest rate risk, effective. Dts), is a market standard for measuring the credit volatility of a corporate bond. It is calculated by simply. credit spread is the difference between the yield (return) of two different debt instruments with the same maturity. Spread Duration Of Credit.

From www.projectfinance.com

3 Best Credit Spread for Options Strategies projectfinance Spread Duration Of Credit duration times spread (dts) is the market standard method for measuring the credit volatility of a corporate bond. spread duration is a measure of the percentage change in a bond’s price for a given change in its credit spread. spread duration is the sensitivity of a security’s price to changes in its credit spread. spread duration. Spread Duration Of Credit.

From www.projectfinance.com

Credit Spread Options Strategies (Visuals and Examples) projectfinance Spread Duration Of Credit spread duration is the sensitivity of a security’s price to changes in its credit spread. It is calculated by simply. duration times spread (dts) is the market standard method for measuring the credit volatility of a corporate bond. It quantifies the sensitivity of a bond’s price. spread duration is a measure of the percentage change in a. Spread Duration Of Credit.

From www.projectfinance.com

Credit Spread Options Strategies (Visuals and Examples) projectfinance Spread Duration Of Credit spread duration is the sensitivity of a security’s price to changes in its credit spread. In other words, the spread is the difference in returns due to different credit qualities. spread duration is ideal for analyzing credit risk, modified duration for assessing interest rate risk, effective. credit spread is the difference between the yield (return) of two. Spread Duration Of Credit.

From www.inkl.com

What Is Bond Credit Spread? Example and How to… Spread Duration Of Credit Dts), is a market standard for measuring the credit volatility of a corporate bond. spread duration is the sensitivity of a security’s price to changes in its credit spread. spread duration is a measure of the percentage change in a bond’s price for a given change in its credit spread. credit spread is the difference between the. Spread Duration Of Credit.

From www.projectfinance.com

3 Best Credit Spread for Options Strategies projectfinance Spread Duration Of Credit dxs (duration times spread duration a.k.a. Dts), is a market standard for measuring the credit volatility of a corporate bond. In other words, the spread is the difference in returns due to different credit qualities. It is calculated by simply. spread duration is a measure of the percentage change in a bond’s price for a given change in. Spread Duration Of Credit.

From www.financestrategists.com

Spread Duration Definition, Components, & Applications Spread Duration Of Credit spread duration is the sensitivity of a security’s price to changes in its credit spread. spread duration is a measure of the percentage change in a bond’s price for a given change in its credit spread. spread duration is ideal for analyzing credit risk, modified duration for assessing interest rate risk, effective. duration times spread (dts). Spread Duration Of Credit.

From transacted.io

Spread Duration Explained Transacted Spread Duration Of Credit It is calculated by simply. duration times spread (dts) is the market standard method for measuring the credit volatility of a corporate bond. spread duration is the sensitivity of a security’s price to changes in its credit spread. In other words, the spread is the difference in returns due to different credit qualities. spread duration is a. Spread Duration Of Credit.

From analystprep.com

frmpart2creditspread CFA, FRM, and Actuarial Exams Study Notes Spread Duration Of Credit credit spread is the difference between the yield (return) of two different debt instruments with the same maturity but different credit ratings. spread duration is the sensitivity of a security’s price to changes in its credit spread. It quantifies the sensitivity of a bond’s price. duration times spread (dts) is the market standard method for measuring the. Spread Duration Of Credit.